Cyclic Smoothed RSI with period highlighter

The cyclic smoothed RSI MTF indicator is an enhancement of the Relative Strength Indicator "RSI", adding

- additional smoothing without introducing lag and maintaining clear sharp turns for signal generation,

- adaptive upper and lower bands to avoid whipsaw trades and adapt the indicator to trending/cyclic conditions,

- using the current dominant cycle length as input for the indicator to ensure more accurate change in trend signals,

- using higher time-frame csRSI oversold/overbought conditions to automatically highlight time windows with green/red backgrounds on the indicator panel for signal filtering and/or alert rules.

This indicator is an advanced version of the public available open-source cyclic smoothed RSI indicator. It provides fully automatic time frame highlighting by using a cyclically smoothed RSI from a higher time frame to indicate time frames with high probability signals. These high probability windows are highlighted when the indicator from the higher time frame is in dynamic overbought or oversold territory.

Overview and Examples

The following chart illustrates how it works and compares it against the basic RSI indicator. The csRSI indicator shows automatic highlighted periods with highlighted red and green time zones. These areas are based on another cyclic smoothed RSI indicator from a higher time-frame. The periods are marked red when the higher time-frame csRSI is above the upper bands and marked green when below the lower dynamic bands.

These colored periods in the indicator panel indicate the time to look for signals from the csRSI indicator. The derived signals are marked on the price chart. While the standard RSI would give too much whipsaw trades as indicated by the questions marks, however. the csRSI MTF version is able to filter the high probability signals while skipping false signals with a clear, objective procedure.

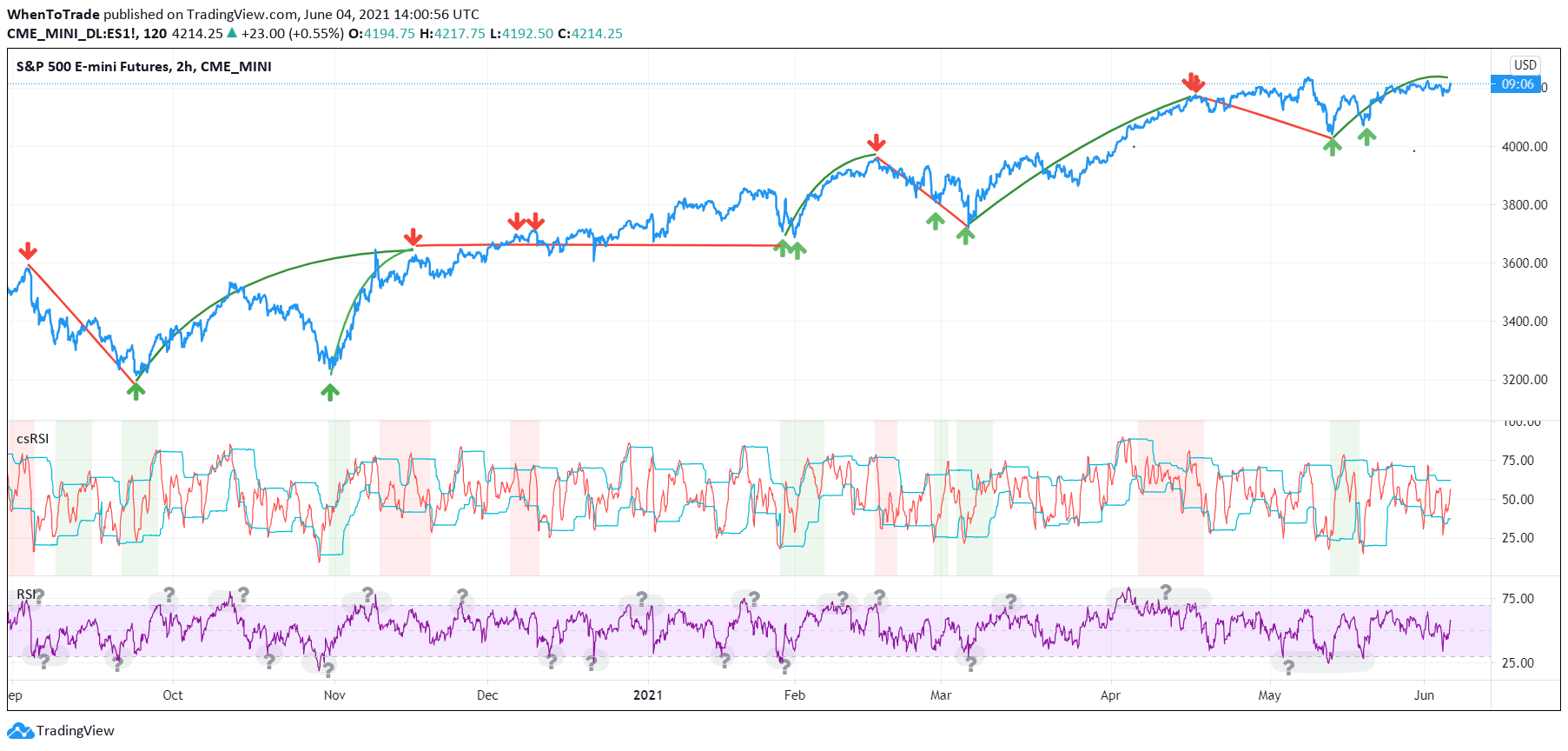

S&P500 EMini Futures

csRSI 2H chart / 1D filter example signals

Chart 1: S&P E-Mini Futures 2h chart with daily higher time-frame filtering period for the csRSI, showing the standard RSI in the lower panel for signal comparison, signals from the csRSI are marked on the price chart

Chart Link: https://www.tradingview.com/x/oETacMVR/

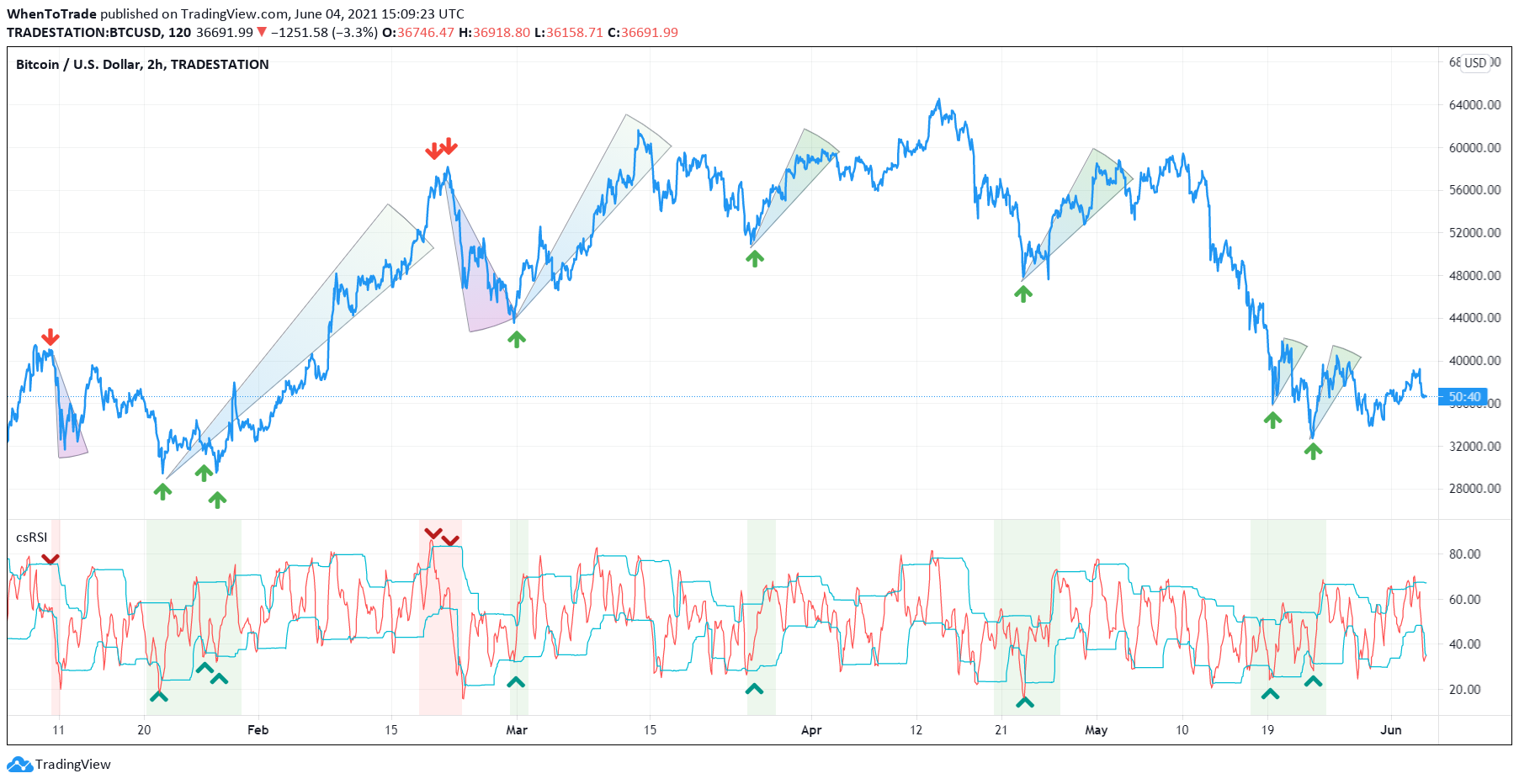

Bitcoin BTC/USD

csRSI 2H chart / 1D filter example signals

Chart 2: Bitcoin BTC/USD 2h chart with daily higher time-frame filtering period for the csRSI, signals marked

Chart Link: https://www.tradingview.com/x/h407gPQm/

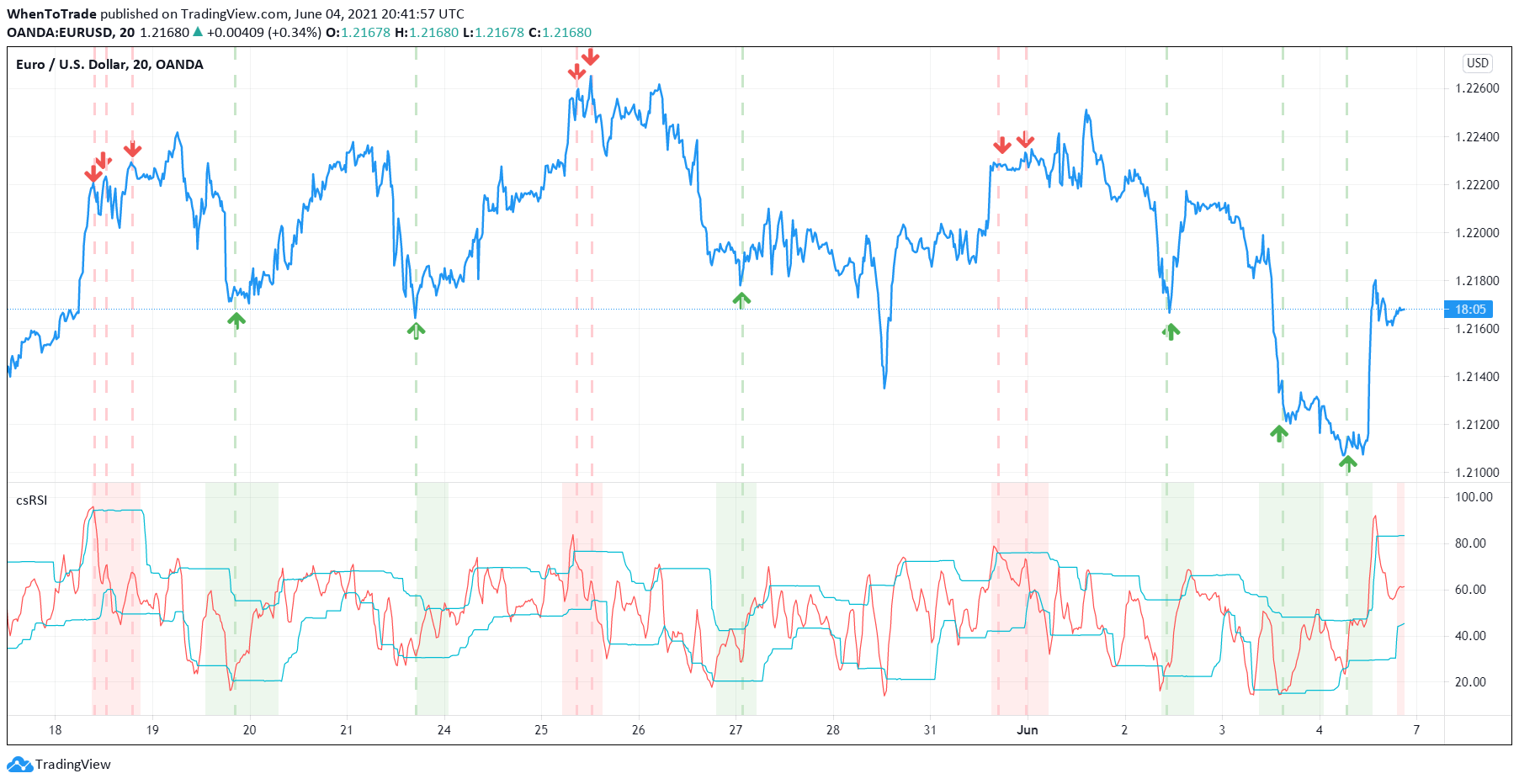

EUR/USD Forex

csRSI 20min chart / 2h filter example signals

Chart 3: Bitcoin BTC/USD 20min chart with 2H higher time-frame filtering period for the csRSI, signals marked

Chart Link: https://www.tradingview.com/x/zx66TIpJ/

Info:

All three examples are setup with the basic standard settings and no additional parameter adjustments. The placed arrows on the price/indicator panel and the projection price areas have been added manually to visualize where the signals are derived based on standard technical indicator oscillator readings (signal turn above/below bands). Due to the nature of the indicator (ultra-smooth, sharp turns, dynamic bands), these signals are easily seen without any whipsaw. (please zoom in)

Features

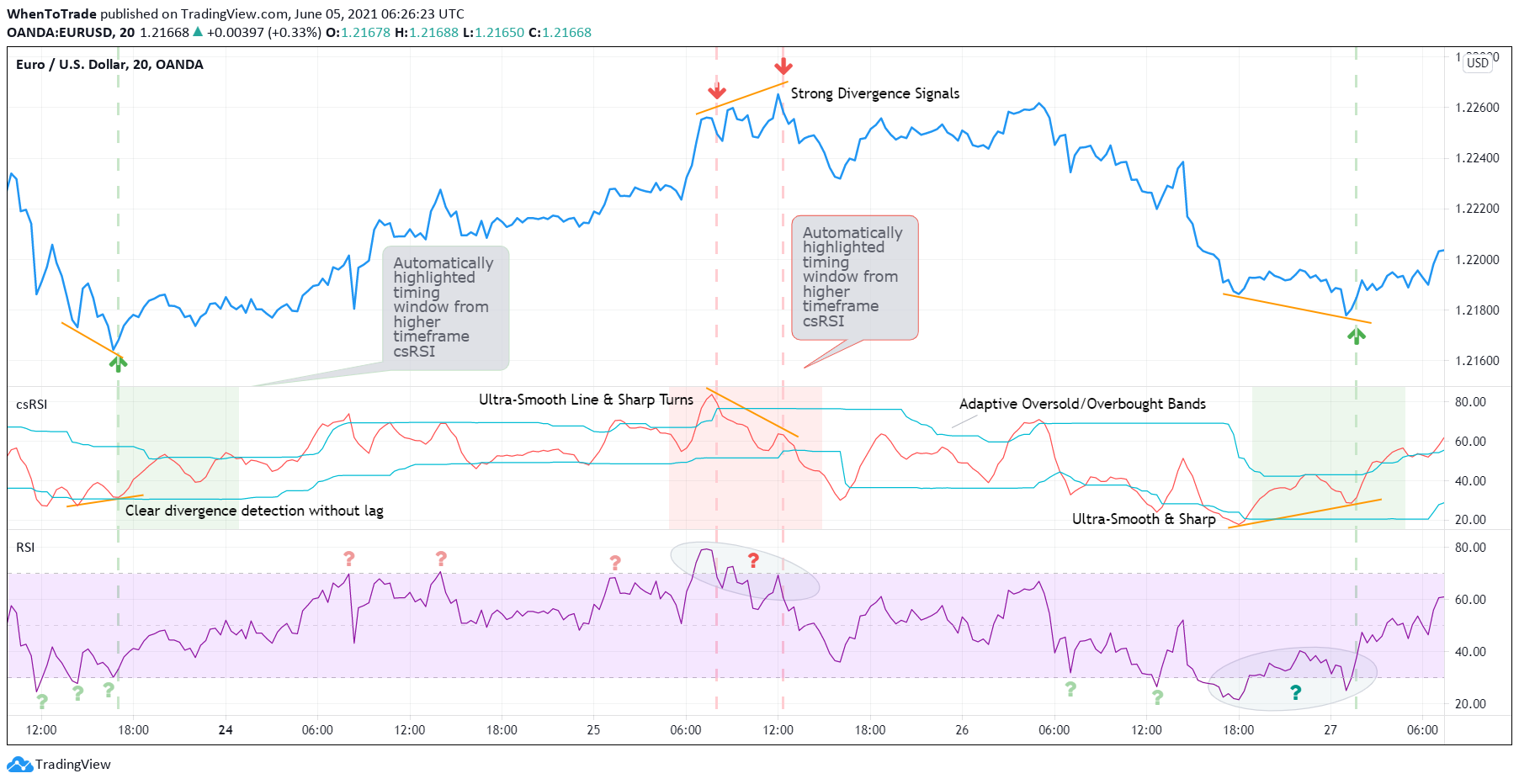

The following chart is a close-up of the EUR/USD example above and shows the forex pair on a 20-minute time frame for the continuous period May 23, 2021 to May 27, 2021. The normal RSI is also plotted for comparison. Since the normal RSI would give too many unclear signals marked with "?", the csRSI first filters the high probability time frames according to the integrated multi time frame filter from the 2h chart. In addition, the smooth indicator line allows very precise detection of turns and divergences using the adaptive bands. In the 4-day period shown, there were 2 clear buy and sell signals. The normal RSI would not have been able to filter the wrong signals from the right ones.

Chart: EUR/USD 20 min chart with csRSI signals and key features

Link: https://www.tradingview.com/x/ekN6ULpq/

Multi-Time-Frame filtering

...

Ultra-smooth indicator

.... (without lag)

Dynamic adaptive bands

.....

Cycle-tuned sharp signals

....

Settings & Parameter

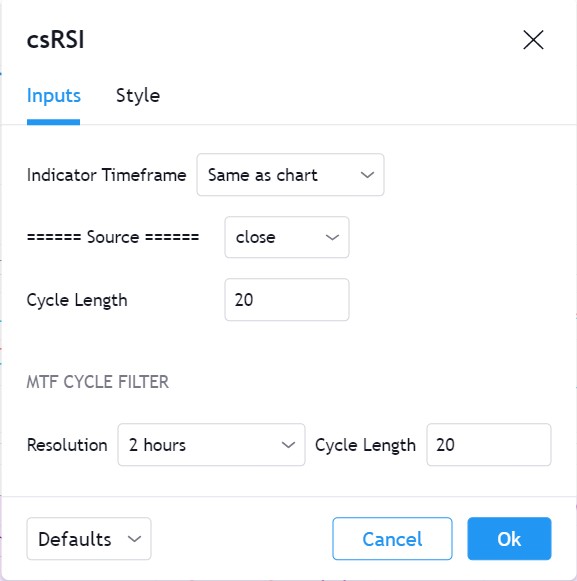

The Inputs section allows you to select the time frame for the indicator signals. We recommend keeping the indicator time-frame according to your chart time frame ("Same as chart"). The cycle length allows to improve the signals by entering the dominant cycle length of the analyzed dateset. This parameter is optional if the current dominant cycle is not known. In that case, leave it at 20. The dominant cycle length can even improve the indicator signal generation. The examples above have not been optimized by using the dominant cycle length and just used the standard setting of 20.

The MTF CYCLE FILTER area is used to set the time-frame used as filter to plot the colored indicator background in red and green areas when the higher time-frame indicator is above (red) or below (green) the dynamic bands. These indicate the period of time with high probability to look for signals on the main indicator line.

|

|

Chart: csRSI MTF Indicator Settings Panel

The MTF Resolution parameter input is important for generating the highlighted red/green areas on the indicator panel. You must enter a higher time-frame than your indicator time-frame in order to get the reliable highlighting. You can enter the current dominant cycle length on the chosen higher time-frame resolution to even further optimize the indicator accuracy.

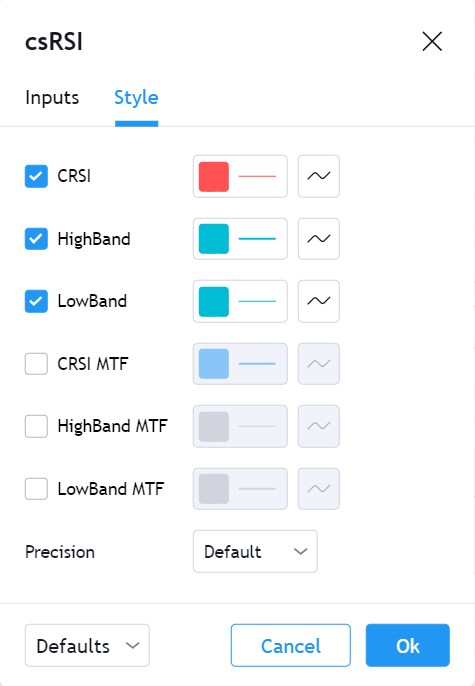

The Style sections allows to active/de-active individual plots. The standard setting disables the higher time-frame csRSI indicator which is only used to indicate the colored areas. If required, you can also enable the MTF indicator and adaptive bands to be plotted in the same indicator panel. The values shown in the style section also indicate which values are available for individual alert generation.

Automatic Signals & Alerts

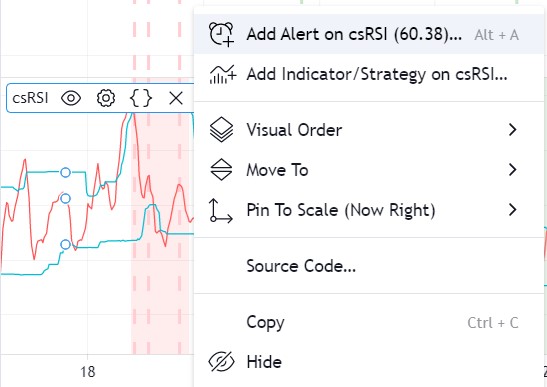

It is possible to create your own automatic signals with the csRSI MTF indicator using the TradingView alarm function. Click on the three dots "More" beside the indicator name label and select "Add Alert on csRSI ..." from the context menu.

Chart: Configure csRSI alert to get notified once a symbol gets into the time zones of interest (red/green)

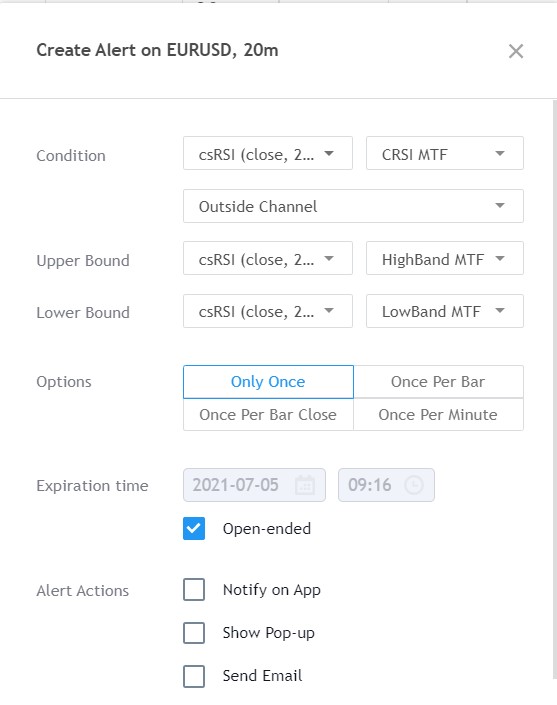

For example, if you want to receive an alert when the high probability periods (red/green highlighted areas) have been reached for a monitored symbol without manually watching the indicator panel, you can set up a custom alert. The csRSI indicator provides the raw values necessary to set up your alarm conditions. Set the "CSRSI MTF" as the value for the "Out of Channel" condition and select the "HigBand MTF" and "LowBand MTF" indicator values as the upper and lower limit parameters in the alarm's dialog box. Once you have set up this alarm, you will not need to monitor your charts manually. The TradingView alarm will inform you as soon as an important time zone is reached. These are the situations when you would open the chart and watch for trigger signals on the indicator line. If you set up this alert as an email, you can even focus on other things and let the csRSI MTF highlighter condition alert you when you should pay attention to the trading chart.

Chart: Example csRSI alert setup

Basic Usage & Trade Signals

Classic rules apply as with every technical oscillator. In addition use this indicator to identify the following conditions:

- Indicator turns above/below the adaptive upper and lower bands (expected trend reversals)

- Indicator crosses below upper band / crossed above lower band (start of trend reversal)

- Indicator crosses above upper band / crossed below lower band (trend continuation/confirmation)

- Divergence between price / indicator indicate strong signal confidence

- Hidden divergences between price/indicator indicate string signal confidence

- After strong price movements, wait for the second signal confirmed by a divergence

- Use the mentioned conditions in the highlighted red/green periods indicated by the MTF settings